British Govt Asks Competition Authority to Investigate Ultra Electronics Takeover By Cobham

The British government will review Cobham Group's proposed acquisition of Ultra Electronics, citing potential “national security concerns” about the deal.

While Cobham and Ultra are both based in the United Kingdom, Cobham is owned by U.S. private equity firm Advent International. The takeover is estimated to be worth 2.6 billion pounds ($3.56 billion).

UK Business Secretary Kwasi Kwarteng directed Competition and Markets Authority (CMA) to examine the acquisition and sharing of sensitive information between the two companies. "The UK is open to business, however foreign investment must not threaten our national security," the minister tweeted August 18, 2021.

The CMA will have until January 18, 2022, to complete its work and report its findings to Kwarteng. The secretary will then decide whether to clear the merger with or without conditions or instruct the CMA to conduct a more in-depth “Phase 2” investigation.

A law of 2002 allows the British government to prohibit a merger or a takeover when this could have an impact on national security and defense, the plurality of media, the stability of the financial system, or even public health. This law dating from the early 2000s will also be strengthened in early 2022 with new measures.

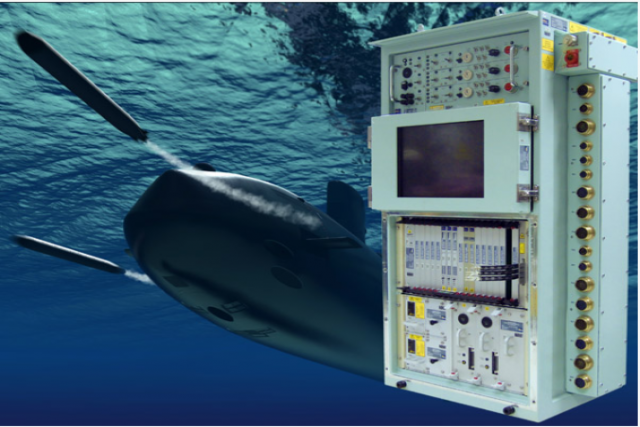

Ultra electronics focuses on military communications, in particular with the Royal Navy for which it participates in the manufacture of sonar. It also services the members of the "Five Eyes" network of intelligence collaboration which includes the United Kingdom, United States, Canada, Australia and New Zealand.

Cobham has indicated it is willing to address any concerns that policymakers might have about its Ultra takeover. The company has agreed to work with the UK government to ensure the deal protects capabilities that are critical to the UK national security.